Minniesota Information Returns - Form W-2 & 1099

All employers required to withhold Minnesota income tax must register for a tax account.

The Form 1099 Series for ExpressTaxFilings consists of Forms 1099-INT, 1099-MISC, and 1099-DIV. his series of forms is used to report various types of “Other Income” not including wages, salaries, and tips.

Form 1099 is typically used when the taxpayer has received income from sources other than a wage-paying job. There are eleven different variations to the 1099 forms, the type of income being reported will determine which form you will need to use. Form 1099 is only required if the payment amount is greater than $600 during the calendar year.

| Forms | Due Dates(Federal) | Notes | |

|---|---|---|---|

| Paper Filing | E-Filing | ||

| 1099-MISC Miscellaneous Income | February 29th | March 31st | Annual tax statement to report for each person to whom you have paid during the year: royalties, rents, services, prizes and awards, fishing boat proceeds, or gross proceeds paid to an attorney. |

| 1099-INT Interest Income | February 29th | March 31st | Annual tax statement to report for each person to whom you have paid during the year: interest income, tax-exempt interest, U.S. Treasury or Savings bonds, or any other applicable interest. |

| 1099-DIV Dividends and Distributions | February 29th | March 31st | Annual tax statement to report for each person to whom you have paid during the year: capital gains, Section 1202 gains, exempt-interest dividends, or any other applicable dividends or distributions. |

| W-2 | February 29th | March 31st | Form W-2 is a summarization of an individual employee’s wages, tips, any other applicable compensation, or taxes withheld |

| W-2c | February 29th | March 31st | Form W-2c is a corrective form for any errors made on an employee’s W-2 |

| 1099-R | February 29th | March 31st | Form 1099-R is for reporting distributions from pensions, annuities, IRAs, or any other applicable retirement or profit-sharing plans. |

Minnesota does not require any specific forms outside of Forms W-2 and 1099, however, if the forms in total number 10 or more, e-filing is required and may be done at:https://www.mndor.state.mn.us/tp/eservices/_/#1

If fewer than 10 forms are being filed, paper filing can be done at:

Minnesota Revenue

Mail Station 1173

ISt. Paul, MN 55146-1173

Due Date: February 29th of the year following the year in which the forms are in reference to.

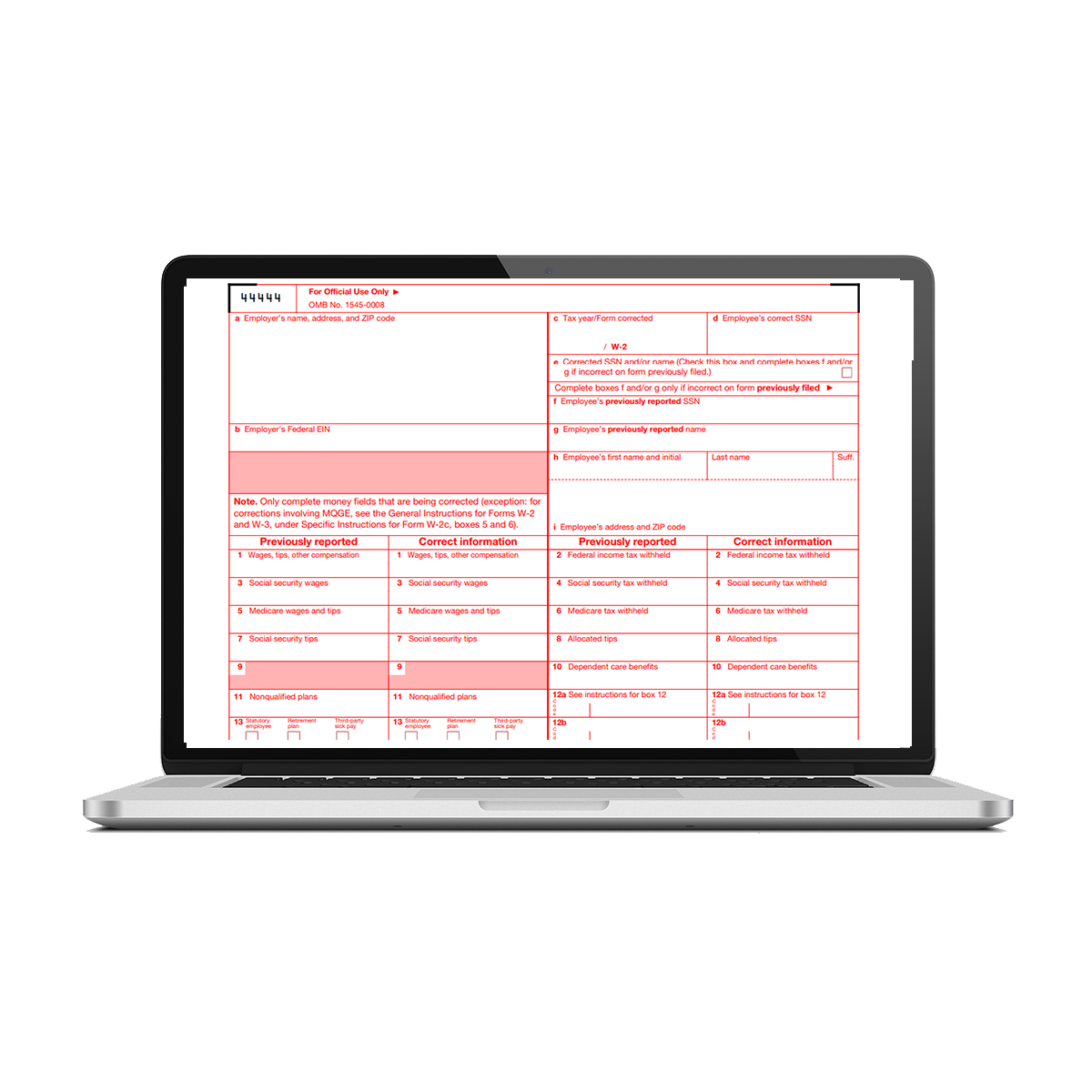

Form W-2c

Form W-2c is for correcting any errors entered in Form W-2. Filers may use ExpressTaxFilings to easily edit and fix any incorrect W-2s originally filed with ExpressTaxFilings.com. If the filer submitted Form W-2 through ExpressTaxFilings.com and the return was accepted by the IRS, they can make corrections of that form by going to ‘Submitted Forms’ on the dashboard, choose the correct form and click ‘Make Corrections’ under Options.

The filer will then select the Payer and the form that needs to be corrected. This will open a Form W-2 C, where they will be able to update the correct information. Correct errors (such as incorrect name, SSN, or amount) on a previously filed Form W-2 or Form W-2c.

If they are correcting only an employee's name and/or SSN, complete Form W-2c boxes d through i. Do not complete boxes 1 through 20. Have the employee correct the SSN and/or name on his or her original Form W-2. If the employee has been given a new social security card following an adjustment to his or her resident status that shows a different name or SSN, file a Form W-2c for the most current year only.

In order to correct an incorrect tax year and/or EIN on a previously submitted Form W-2, enter the tax year and EIN originally reported, and enter in the “Previously reported” boxes the money amounts that were on the original Form W-2. In the “Correct information” boxes, enter zeros. Prepare a second Form W-2C and enter zeros in the “Previously reported” boxes, and enter the correct money amounts in the “Correct information” boxes. Enter the correct tax year and/or correct EIN.

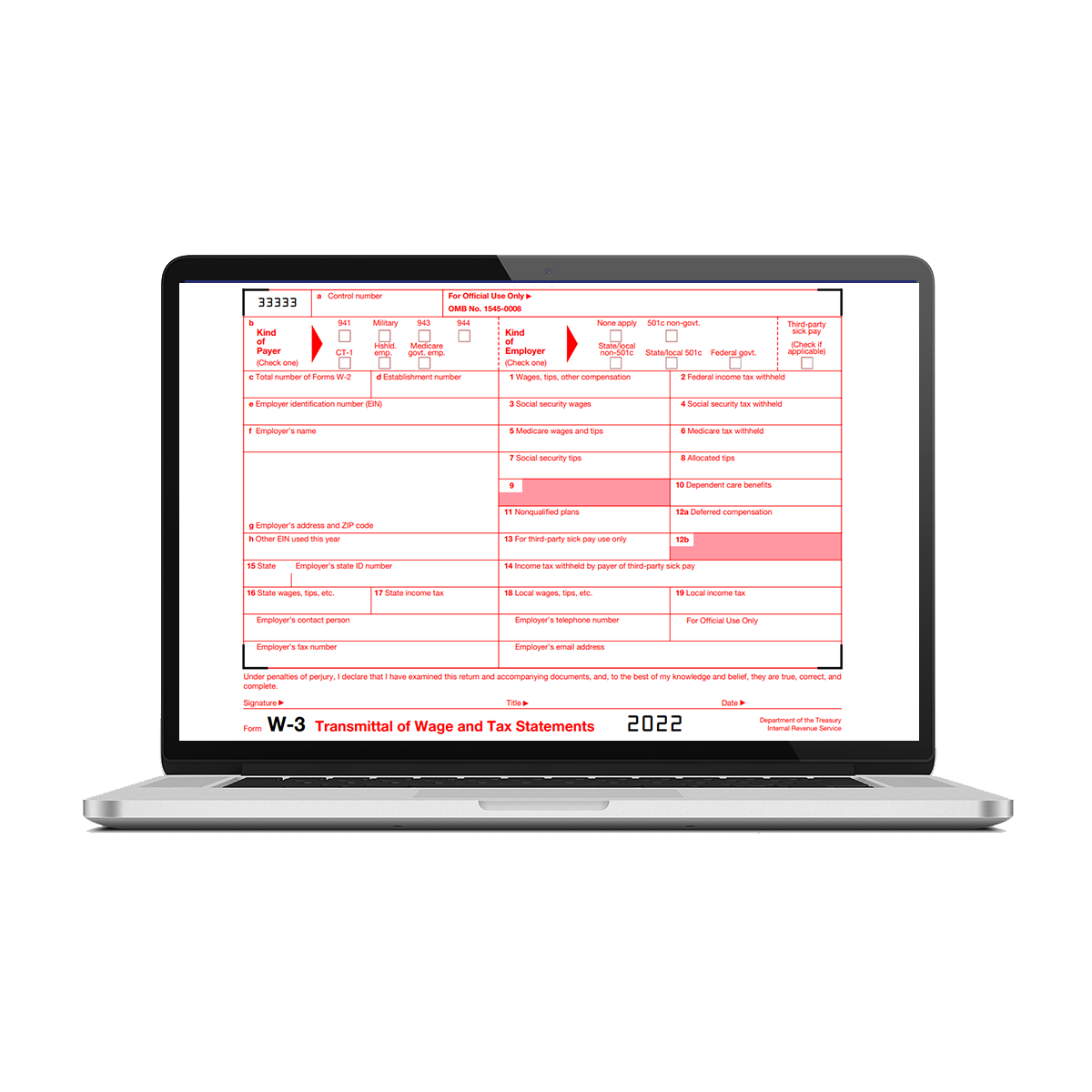

Form W-3

Form W-3 is a reconciliation form used to summarize all wages and withholdings, as well as any other applicable information. This form includes the total amount for all employees that worked for the employer during the tax year.

Anyone who paper filed Form W-2 must file Form W-3 to send with Copy A of Forms W-2 to the SSA. Even if there is only one paper W-2 form being filed a W-3 is still required. Do not file a W-3 for Form(s) W-2 that were submitted electronically to the SSA.

A transmitter or sender may sign Form W-3 (or use their PIN to e-file) for the employer or payer only if the sender is authorized to sign by an agency agreement (whether oral, written, or implied) that is valid under state law; and it reads “For (name of payer)” next to the signature. (This applies to paper filing of Form W-3 only).

To correct a W-3 the filer can use the current version of Form W-3c to correct errors. Corrections may be made from an error on a previously filed Form W-3 or Form W-3c. They must file Copy A of Form W-3c with the SSA.

Corrections reported on Form W-2c may require the filer to make corrections to their previously filed employment tax returns using the corresponding “X” form, such as Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund; Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund; Form 944-X, Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund; or Form CT-1X, Adjusted Employer's Annual Railroad Retirement Tax Return or

Claim for Refund.

Information Returns - IRS

Form W-2

A form 1099 is used to report a variety of unique income payment types to the IRS. This form is typically used when the taxpayer has received income from sources other than a wage-paying job. There are several different variations to the 1099 forms themselves. The specific 1099 form is determined depending on the type of income being reported.

- Form 1099-MISC

- Form 1099-INT

- Form 1099-DIV

- Form 1099-R

Due Date: February 29th of the year following the year in which the forms are in reference to.

Form 1099 MISC

Form 1099-MISC, Miscellaneous Income, is used to report payments for services performed for a business by people not treated as its employees. Report royalties, rents, services, prizes and awards, fishing boat proceeds, or gross proceeds paid to an attorney in the Form 1099-MISC. A 1099-MISC form must be provided to the recipients and a copy should be filed or E-filed with the IRS.

Form 1099 INT

Form 1099-INT, is an IRS tax form used by payers such as banks to report to the IRS regarding the interest paid to recipients. It is used to report interest income, tax-exempt interest, U.S. Treasury or Savings bonds, or any other applicable interest. February 1, 2023 is the due date to distribute copies of Form 1099-INT to a recipient.

Form 1099 DIV

Form 1099-DIV, Dividends and Distributions is a yearly tax statement provided to the investors by investment fund companies. It is used to report capital gains, Section 1202 gains, exempt-interest dividends, or any other applicable. February 1, 2023 is the due date to distribute copies of Form 1099-DIV to the recipient. If filing by paper it is March 1, 2023; if by e-filing means March 31, 2023.State Resources

Form W-2/1099 Filing Information

http://www.revenue.state.mn.us/businesses/

withholding/Pages/IneedtofileW21099.aspx

Minnesota Department of Revenue: Business Page

http://www.revenue.state.mn.us/businesses/

Pages/Tax-Types.aspx

Help Videos

Adding Payers & Recipients

When creating a 1099 or W-2 through ExpressTaxfiling, you can easily save the Payer and Recipient for each Form and reuse this information in the future.

If you need to file multiple W-2 or 1099 Forms for your business, you can save time by uploading an excel file with all your data and create your forms in just a few clicks.

To get started, go to ExpressTaxfiling and create an account. To save time, you can even login

with google or facebook.

How to E-File a Form 1099?

After logging in, you will be brought to the dashboard. On the Dashboard, you can select which

1099 Form you need to file.

The Form itself is fairly straightforward. All you need to do is enter a Payer, a Recipient, & Generate an Account Number.

After a return is created, the payer & recipient will be saved within your account, so that in the future, you can use this information with just a click.

Express Tax Filings

ExpressTaxFilings is a tax E-File application that helps you file and furnish 1099 Forms including 1099-DIV, 1099-MISC, 1099-OID, 1099-INT, 1099-R, W-9 and W-2 Forms to your recipients all in one place. Our IRS authorized E-File system allows you to file your forms quickly and easily. We are a secured web-based service, so your 1099 forms and W-2 forms will be available to you at any time from any location. As experienced tax professionals within the industry, you can rest assured your Form 1099-DIV and other forms will be E-Filed quickly and simply.

TaxBandits is a part of the ExpressTaxZone line of IRS Authorized products which also includes Express Extension for E-Filing of Form 7004, Form 4868, Form 8868, ExpressTruckTax for E-Filing of Form 2290, Form 2290 Amendments, Form 8849, Schedule 6 and ExpressIFTA for state IFTA report generation. With TaxBandits you can E-File Form 1099-DIV, Form 1099-MISC, Form 1099-INT, Form 1099-OID, Form 1099-R, Form W-9 and Form W-2.

Express Products

Minnesota Paystub Generator

Whether you're in Portland, Lewiston, Bangor or anywhere in Minnesota state, our Paystub generator will calculate the taxes accurately. There is no need for desktop software. Save time and money with the Minnesota paystub generator that creates pay stubs to include all company, employee, income and deduction information. Just follow the simple steps and email your paycheck stub immediately, ready for you to download and use right away.

Get Your First Paystub for Free